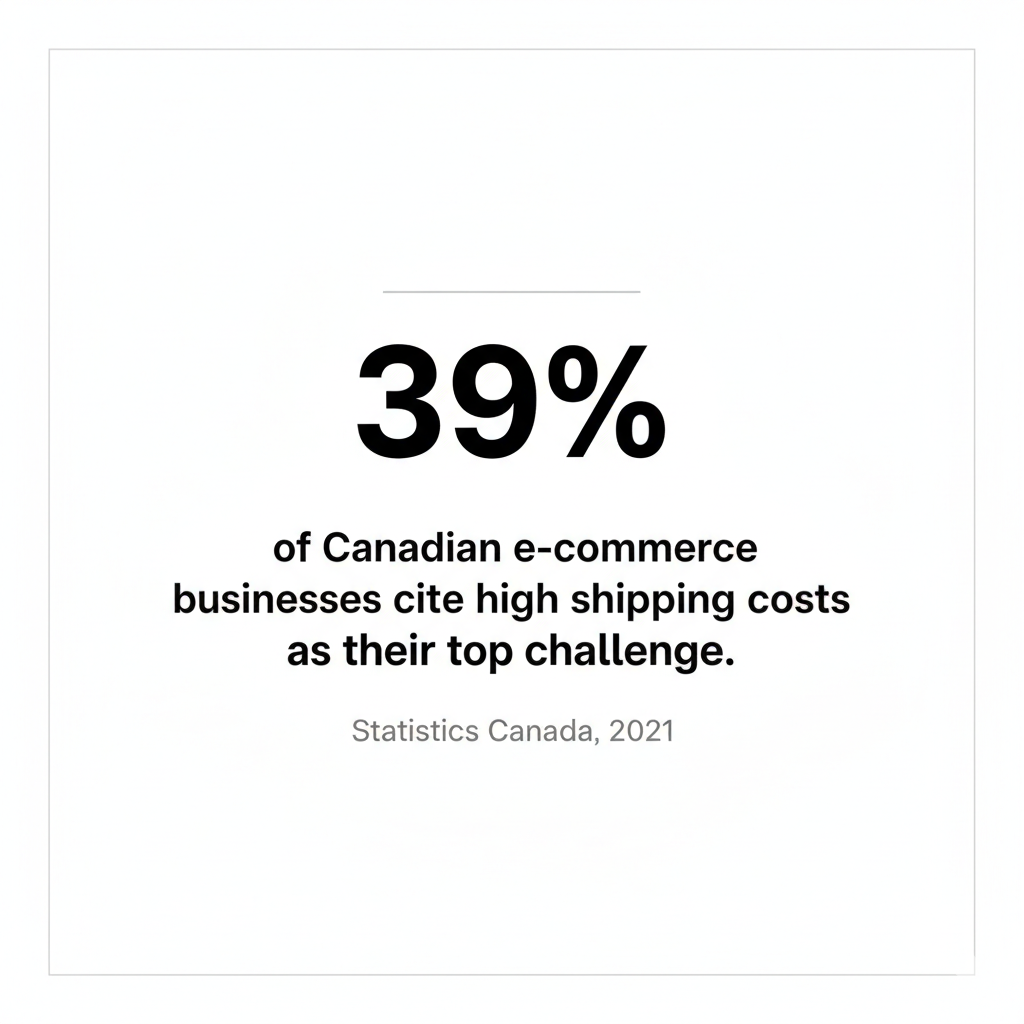

Canadian e-commerce businesses face some of the world’s highest shipping costs. Statistics Canada 2021 E-commerce Survey found that 39% of Canadian e-commerce businesses cite high shipping costs as their top challenge. With e-commerce sales reaching $45.1 billion in 2023 (Statistics Canada, 2024), even small shipping optimizations can dramatically impact your bottom line.

The good news? Canadian businesses across industries are achieving 15-50% shipping cost reductions through strategic optimization. This guide reveals 10 proven strategies that work specifically for Canadian e-commerce operations.

Table of Contents:

- Why Canadian E-commerce Businesses Face High Shipping Costs

- 9 Proven Strategies to Reduce Shipping Costs

- Negotiate Direct Carrier Accounts with Data

- Optimize Package Dimensions and Weight

- Choose Cost-Effective Service Levels

- Review and Negotiate Carrier Surcharges Annually

- Implement Multi-Carrier Strategies

- Leverage Shipping Technology Beyond Label Printing

- Access Collective Buying Power

- Audit and Analyze Invoice Data Continuously

- Understand Flat-Rate Program Limitations

- Shipping Cost Optimization Strategies Comparison

- Real Results from Canadian E-commerce Businesses

- Getting Started with Shipping Cost Reduction

- Frequently Asked Questions

Why Canadian E-commerce Businesses Face High Shipping Costs

Canada’s unique geography creates inherent shipping challenges. Our vast distances, sparse population density, and limited carrier competition drive up costs significantly compared to other markets.

Major carriers like Canada Post, UPS, FedEx, Canpar, and Purolator serve Canadian shipments, but their rates vary dramatically by distance, weight, and service level. For example, shipping a 10kg parcel from Vancouver to Toronto costs roughly $21.61 via Canada Post Regular Parcel versus $28.97 via UPS Ground. These figures are illustrative based on small-business/published rates; actual costs vary by account, zone, and date.

The challenge intensifies with General Rate Increases (GRIs). Carriers typically implement 4-6% GRIs yearly, but the actual impact on your costs often exceeds these advertised rates. Here’s why:

Carriers use strategic pricing structures:

- Flat rate increases hit all shipments equally

- Blended rate increases target common shipping profiles more heavily

- Surcharges (fuel, residential, delivery area) often increase at different rates than base prices, compounding your total costs

Most carriers post GRIs quietly on their websites where few businesses notice. Without tracking these changes against your actual invoice data, you won’t realize how much your costs have crept up until it significantly impacts your margins.

The Current Canada Post Strike Impact

As of Oct 8, 2025, Canada Post workers are on strike, creating unprecedented challenges for Canadian e-commerce businesses. Private carriers lack the capacity to absorb all Canada Post volume, creating a perfect storm of operational and financial pressures:

Immediate market impacts:

- Sudden price jumps from overwhelmed carriers

- New contract restrictions limiting flexibility

- Long-term rate locks with unfavorable terms

- “Peak season” surcharges that often become permanent additions

This crisis highlights a critical reality: dependence on any single carrier creates vulnerability. The businesses weathering this disruption best are those who had already diversified their carrier relationships and built operational flexibility into their shipping strategy.

⚠️ 2025 Peak Holiday Shipping Season Alert

Updated Oct 8, 2025. Carrier surcharges and strike status change quickly—figures below reflect the latest published guides.

Peak Season Is Here: Q4 represents the busiest shipping period of the year, with November-December volume creating capacity constraints and triggering significant carrier surcharges across the Canadian market.

Typical Q4 Peak Season Surcharges:

- Residential Delivery: $5.95-$6.95 per package depending on carrier and service level

- Additional Handling: $28.45-$31.85 per shipment for packages requiring special handling due to dimensions, weight, or packaging (UPS Canada 2025)

- Large Package Surcharge: $112.05-$123.65 per shipment for packages exceeding standard size thresholds (UPS Canada 2025)

- Over Maximum Limits: $1,315+ per shipment for packages exceeding carrier maximums (UPS Canada 2025)

- Peak/Demand surcharges: Variable amounts applied during highest-volume weeks, calculated based on volume increases above baseline periods

- Extended Area Surcharges: Additional fees for rural and remote deliveries (amounts vary significantly by location and carrier)

Surcharge amounts vary by carrier. Figures shown fromUPS Canada 2025 Rate Guide; consult current rate guides fromFedEx Canada,Purolator, andCanparfor complete comparison. Always check your account-specific surcharge schedule for the latest applicable fees.

Q4 2025 Market Pressures:

- Capacity constraints: Carriers prioritize high-volume shippers during peak season, potentially delaying shipments from smaller businesses

- Extended peak season: Peak surcharges now often begin in early fall (late September/early October) and extend into the new year, expanding beyond the traditional November-December window

- “Temporary” becomes permanent: Historical pattern shows peak season surcharges often remain in place long after capacity normalizes

- Service level degradation: Despite premium pricing, delivery times typically extend 1-2 days during peak periods as networks reach capacity

Immediate Action Items for Q4 2025:

- Lock in rates early – negotiate favorable terms before holiday volume reaches its highest levels

- Diversify carriers now – single-carrier dependency creates maximum risk during peak season disruptions

- Document all surcharges – track which “temporary” peak fees remain after the new year for contract negotiations

- Set customer expectations early – communicate realistic delivery windows for holiday orders

- Consider early fulfillment – shipping before mid-November often avoids the highest surcharge tiers

Surcharge data based on FedEx Canada 2025 Rate Guide and carrier announcements. This section is updated regularly to reflect current market conditions and seasonal challenges.

9 Proven Strategies to Reduce Shipping Costs

1. Negotiate Direct Carrier Accounts

Most carriers offer business accounts with volume discounts significantly better than standard rates. Canada Post’s Solutions for Small Business program provides up to 32% off domestic shipments, while FedEx advertises up to 45% savings for new accounts.

However, getting these rates requires more than just signing up. The key is establishing shipping history and demonstrating consistent volume.

Carriers avoid providing their best rates in public forums like shipping platforms or industry associations. Why? They don’t want those rates used as negotiation baselines by other customers. The best rates come through direct negotiation with actual volume commitments.

Even modest monthly volumes can qualify for meaningful discounts when you have data proving your shipping patterns.

2. Optimize Package Dimensions and Weight

Dimensional weight pricing means you pay for space, not just weight. A large box containing a small item triggers higher “dimensional weight” charges based on package volume.

Here’s the insider detail most businesses miss: Carriers penalize you more heavily when dimensional weight penalties align with your most common shipping lanes. If your typical package dimensions consistently trigger dimensional weight charges to your top three destination provinces, you’re losing significant money on every shipment.

Key optimization tactics:

- Use appropriately sized packaging to minimize empty space

- Choose lightweight packaging materials like padded mailers for non-fragile items

- Review dimensional triggers annually as carriers adjust thresholds

- Test whether splitting large orders into multiple smaller packages reduces total costs

- Regularly audit packaging to ensure ongoing efficiency

As Shopify notes, “Don’t ship air! Always aim for the smallest possible package dimensions” to avoid unnecessary dimensional weight penalties.

3. Choose Cost-Effective Service Levels

Express shipping costs significantly more than standard ground service, but here’s what most businesses don’t realize: within provinces or between neighboring provinces, express and ground shipments often move on the same truck.

Express only creates true value when air transport is required — typically for cross-country or time-critical shipments. For shorter distances, you’re paying a premium for the same delivery speed.

Strategic approach:

- Plan ahead to use ground options whenever customer expectations allow

- Offer customers expedited shipping as a paid upgrade

- Default to economical ground service for standard orders

- Track actual delivery times by carrier and route to identify where express doesn’t add value

Delivery-speed tiers by region:

Set realistic delivery expectations based on geography. Metro regions naturally maintain faster ETAs, while rural and remote regions should show longer windows with optional paid upgrades. This helps avoid unnecessary express shipping upgrades when customers simply assume faster shipping means better service—but in many cases, ground service meets their actual needs perfectly.

The UPS Store confirms that “fast delivery equals more expensive delivery”, so shipping early by ground saves substantial money compared to last-minute air services.

4. Review and Negotiate Carrier Surcharges Annually

Fuel, residential, and delivery area surcharges can add 10-30% to your base shipping costs. These surcharges change independently from base rates, and carriers adjust them differently across their pricing structures.

Why this matters: During your last carrier negotiation, you might have focused on reducing base rates while surcharges remained untouched or even increased. Over time, surcharge increases can completely offset your negotiated base rate discounts.

The most common surcharges hitting Canadian e-commerce:

- Fuel surcharges fluctuate weekly (12-20% of base rates) but rarely decrease as quickly as they increase

- Residential delivery ($1-$5 per package) hits every e-commerce shipment to homes

- Delivery Area Surcharges can range widely—often $25–$150 per package for rural and remote regions—but amounts vary by carrier and account type. Always check your current surcharge schedule for the latest applicable fees.

- Peak/Demand surcharges were rebranded from seasonal to year-round application—what starts as “temporary” often becomes permanent

Request a complete surcharge schedule annually and compare it to previous years. Negotiating surcharges separately from base rates often yields additional savings that most competitors overlook.

Additional surcharge strategies:

- Map remote postal codes and identify where DAS applies most heavily

- Prefer carriers with stronger rural pricing on those lanes

5. Implement Multi-Carrier Strategies

Using multiple carriers provides rate comparison opportunities and crucial service redundancy. Different carriers excel on different routes or service levels, and the Canada Post strike has proven how dangerous single-carrier dependency can be.

Real results: A Montreal healthcare business reduced shipping costs by 40% by expanding from single-carrier (FedEx Express) to an optimized multi-carrier strategy including Purolator, Canpar, and local carriers. The key was strategic carrier selection based on destination and package characteristics.

Smart implementation:

- Compare rates for your most common routes across multiple carriers

- Test carrier performance on key lanes before committing volume

- Build operational flexibility to shift volume when needed

- Don’t consolidate shipments automatically — instead, compare rates for bigger boxes versus multi-piece shipments, as carriers often reward aligning with their preferences

6. Leverage Shipping Technology Beyond Label Printing

Shipping software isn’t just about printing labels — it’s about rate benchmarking, rules-based automation, and integrated reporting that saves both time and money.

Platforms like ShipStation provide instant rate comparisons across carriers, but the real value comes from expert setup that optimizes your specific operation. Proper configuration includes:

Advanced automation capabilities:

- Batch label printing to eliminate manual processing

- Automatic tracking updates that reduce customer service inquiries

- Custom routing rules based on destination, weight, and package characteristics

- Data analysis identifying top destinations and optimization opportunities

- Integration with multiple selling channels for omni-channel efficiency

Strategic advantage: Expert partners can set up automations that automatically select the most cost-effective carrier and service level for each shipment based on your negotiated rates, delivery requirements, and historical performance data.

7. Access Collective Buying Power

Individual businesses often lack the volume needed for optimal carrier rates. This is where collective buying power becomes transformative.

Here’s how it works: Carriers prefer volume aggregation because it creates predictable capacity commitments they can plan around. When multiple businesses combine their shipping volume through a collective buying arrangement, they access enterprise-level rates normally reserved for companies like Nike or Sephora.

Critical differentiator: Unlike shipping platforms that resell carrier services at marked-up rates, true collective buying arrangements provide members with their own direct carrier accounts. You maintain direct carrier relationships while benefiting from volume-based pricing typically reserved for much larger shippers.

Real results: A Toronto tea company achieved 25% savings through collective buying that provided enterprise-level rates across multiple carriers. This approach works because:

- Carriers get committed volume guarantees

- Members maintain control over their carrier relationships

- Everyone benefits from better rates than they could negotiate individually

- Members share best practices and optimization insights

For SMBs shipping $10,000+ annually, collective buying power often delivers better results with less effort than individual carrier negotiations.

8. Audit and Analyze Invoice Data Continuously

Having analyzable invoice data — not just PDFs — is the single most important step in continuous optimization. Most shipping cost increases happen gradually through small surcharge adjustments, GRI implementations, and rate structure changes that are invisible without proper analysis.

Build a low-friction process:

- Request CSV or Excel format invoices from all carriers

- Run quick analyses quarterly to spot cost increases

- Compare actual costs against your negotiated rates to ensure accuracy

- Track average cost per kilogram by destination province

- Monitor surcharge percentages and their impact on total costs

Why this matters: Carriers rarely notify you when rate structures shift in ways that disadvantage your specific shipping profile. Your invoice data reveals the truth about what you’re actually paying versus what you expect to pay.

Many Canadian businesses discover they’re paying 15-30% more than their contracted rates simply because surcharges, dimensional weight penalties, and GRI increases compounded over time without anyone noticing.

9. Understand Flat-Rate Program Limitations

Canada Post’s flat-rate boxes and similar carrier programs seem appealing — fixed prices regardless of weight up to specified limits. However, flat-rate programs often have built-in carrier margin since carriers buffer for uncertainty.

The reality: Unless your package profile is unusual (heavy but small items), you typically don’t come out ahead with flat-rate programs. Carriers design these programs to be profitable across their average customer base.

Shipping Cost Optimization Strategies Comparison

| Strategy | Time Investment | Potential Savings | Implementation Difficulty |

| Negotiate carrier accounts with data | High | 15–30% | High |

| Optimize packaging | Low | 10–25% | Low |

| Choose appropriate service levels | Low | 20–40% | Low |

| Review carrier surcharges | Medium | 10–20% | Medium |

| Multi-carrier strategy | High | 25–45% | High |

| Implement shipping technology | Medium | 15–40% | Medium |

| Collective buying power | Low | 20–50% | Low |

| Continuous invoice analysis | Medium | 10–30% | Medium |

Real Results from Canadian E-commerce Businesses

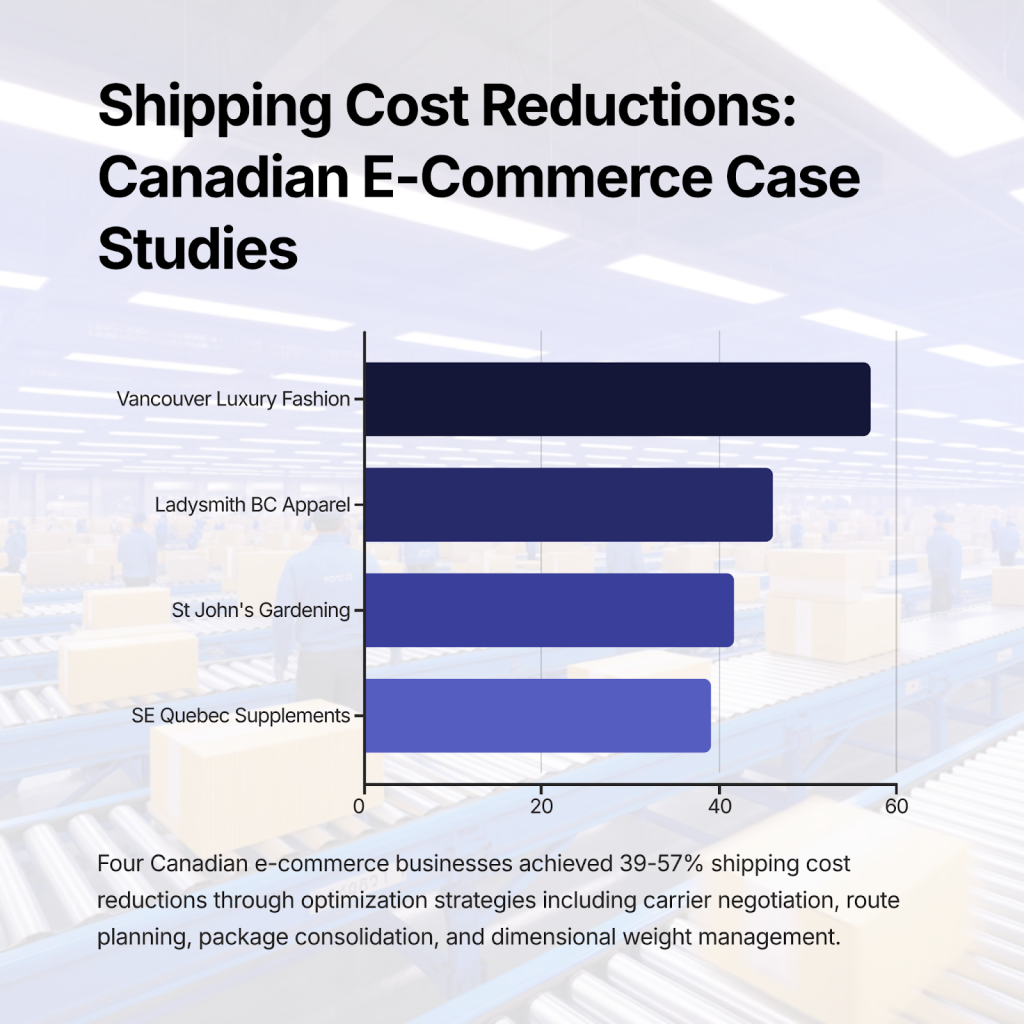

Canadian businesses across industries are achieving significant shipping cost reductions through strategic optimization. These four case studies demonstrate how different optimization approaches deliver results:

St. John’s, Newfoundland Gardening Company: 41.6% Cost Reduction

The Challenge: Remote location expanding nationally with platform markup layers limiting growth

Before:

- Platform: Shiptime (public rates with markups)

- Carriers: Canpar, Purolator, UPS through platform

- Product: Low-weight gardening products

After:

- Platform: ShipStation with direct carrier integration

- Carriers: Direct contracts with Canpar, Purolator, UPS

- Implementation: 10 days

Result: 41.6% savings enabled profitable national expansion from remote Newfoundland base—previously cost-prohibitive with platform dependencies.

Ladysmith, BC Apparel Manufacturer: 46% Savings

The Challenge: Manual carrier management consuming time while lacking volume leverage for enterprise rates

Before:

- Platform: Direct carrier relationships without automation

- Carriers: Canada Post, Purolator, UPS (managed individually)

- Average package: 2 lbs

- Sales channels: Shopify, Etsy

After:

- Platform: ShipStation with automated carrier selection

- Carriers: FedEx, Canpar (enterprise rates through collective buying power)

- Implementation: 22 days

Result: 46% savings plus automated carrier management. Enterprise rates through collective buying power made US market expansion viable.

Southeastern Quebec Supplements Retailer: 39% Cost Reduction

The Challenge: Single-carrier limitation with manual fulfillment processes consuming 10+ hours weekly

Before:

- Platform: WooCommerce basic shipping

- Carriers: Purolator only

- Package range: Small (5 lbs), Medium (10 lbs), Large (20 lbs)

After:

- Platform: ShipStation with multi-carrier automation

- Carriers: Canpar, Purolator, FedEx with automated selection

- Implementation: 12 days

Result: 39% cost savings plus 10+ hours weekly saved on shipping operations through bulk processing and automated carrier selection.

Vancouver Luxury Fashion Company: 57% Savings

The Challenge: Single-carrier dependency creating cost and risk exposure for irreplaceable luxury goods

Before:

- Platform: Shopify basic shipping

- Carriers: UPS only (complete dependency)

- Product: High-value, irreplaceable fashion items

After:

- Platform: ShipStation with strategic multi-carrier routing

- Carriers: Canpar, Purolator, FedEx (diversified mix)

- Implementation: 12 days

Result: 57% savings with crucial backup options protecting brand reputation. Optimized US shipping reliability essential for luxury market positioning.

Key Takeaway: Savings of 20-50% are achievable across different industries, locations, and shipping volumes. The optimal strategy depends on your current setup—platform dependencies, carrier relationships, package characteristics, and geographic challenges all influence which optimizations deliver the greatest impact.

Getting Started with Shipping Cost Reduction

Begin by auditing your current shipping operations:

- Analyze your shipping data: Review the past 6-12 months of shipping invoices to identify patterns in destinations, package sizes, and service levels used.

- Calculate your true shipping costs: Include all fees, surcharges, and hidden costs to understand your baseline. Request analyzable formats (CSV/Excel) from all carriers.

- Research carrier alternatives: Get quotes from multiple carriers for your typical shipping patterns. Don’t rely on public platform rates — request direct account quotes.

- Review surcharge schedules: Compare current fuel, residential, and area surcharges against previous years to quantify their impact.

- Test optimization strategies: Start with low-effort changes like package optimization and service level adjustments before implementing more complex solutions.

- Consider professional analysis: Many businesses benefit from expert shipping analysis to identify optimization opportunities they might miss on their own.

The key is starting somewhere. Even basic optimizations like negotiating carrier discounts or using appropriately sized packaging can generate immediate savings. More advanced strategies like multi-carrier approaches or collective buying programs deliver even greater results as your shipping volume grows.

See How Much You Can Save — Risk-Free

Part n Parcel handles all the strategies outlined above — from carrier negotiations and surcharge reviews to multi-carrier optimization and collective buying power — on a 100% pay-for-performance basis.

You only pay when you save money. No monthly fees, no setup costs, no risk.

Our network of 240+ Canadian e-commerce businesses provides the collective buying power that unlocks enterprise-level rates. You get your own direct carrier accounts, expert setup and automation, and ongoing optimization based on continuous invoice analysis.

Show Me My Savings →

Frequently Asked Questions

Why are Canadian shipping costs so high?

Canadian shipping costs are among the highest in the world due to several structural factors. Canada’s vast geography means longer average shipping distances—shipping coast-to-coast covers over 4,000 km. Our sparse population density (4 people per square kilometer versus 36 in the US) means carriers can’t achieve the same route density and efficiency. Limited carrier competition in many regions reduces pricing pressure. Additionally, Canada’s harsh winter weather increases operational costs, and cross-border complexities add administrative overhead. These factors combine to create base shipping costs 30-50% higher than comparable US routes.

What is a General Rate Increase (GRI)?

A General Rate Increase (GRI) is the annual price increase that carriers implement across their rate structures. GRIs typically range from 4-6% annually, but the actual impact on your costs often exceeds these advertised rates because surcharges (fuel, residential, delivery area) often increase at different rates, compounding your total costs.

What is collective buying power in shipping?

Collective buying power aggregates shipping volume from multiple businesses to access enterprise-level carrier rates that individual small businesses cannot negotiate on their own. Members get their own direct carrier accounts while benefiting from the collective volume’s negotiating leverage. This differs from shipping platforms that resell carrier services at marked-up rates.

How often should I review my shipping costs?

Review your average costs by weight and destination province at least once annually. Carriers adjust rate structures, surcharges, and dimensional weight thresholds throughout the year, and these changes compound over time. Quarterly quick analyses help catch significant cost increases before they severely impact your margins.

Canadian e-commerce businesses don’t have to accept high shipping costs as inevitable. With strategic optimization, most companies can achieve 20-40% cost reductions while maintaining or improving service levels. The businesses that take action on shipping optimization gain a significant competitive advantage in Canada’s growing e-commerce market.